Your Social Security Roadmap

Consider how your assets are allocated and if that allocation is consistent with your time frame and risk tolerance.

Coaches have helped you your whole life, in ways big and small. We'd like to be one of them.

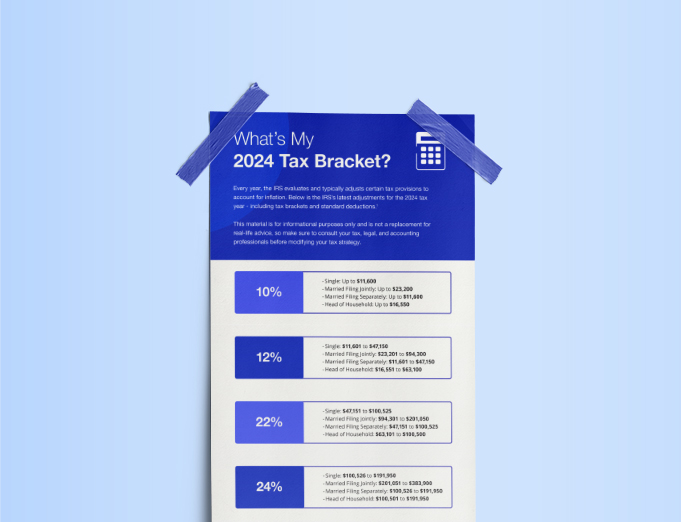

Check out this handy reference of updated ranges from the IRS in case your designated bracket has changed.