01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

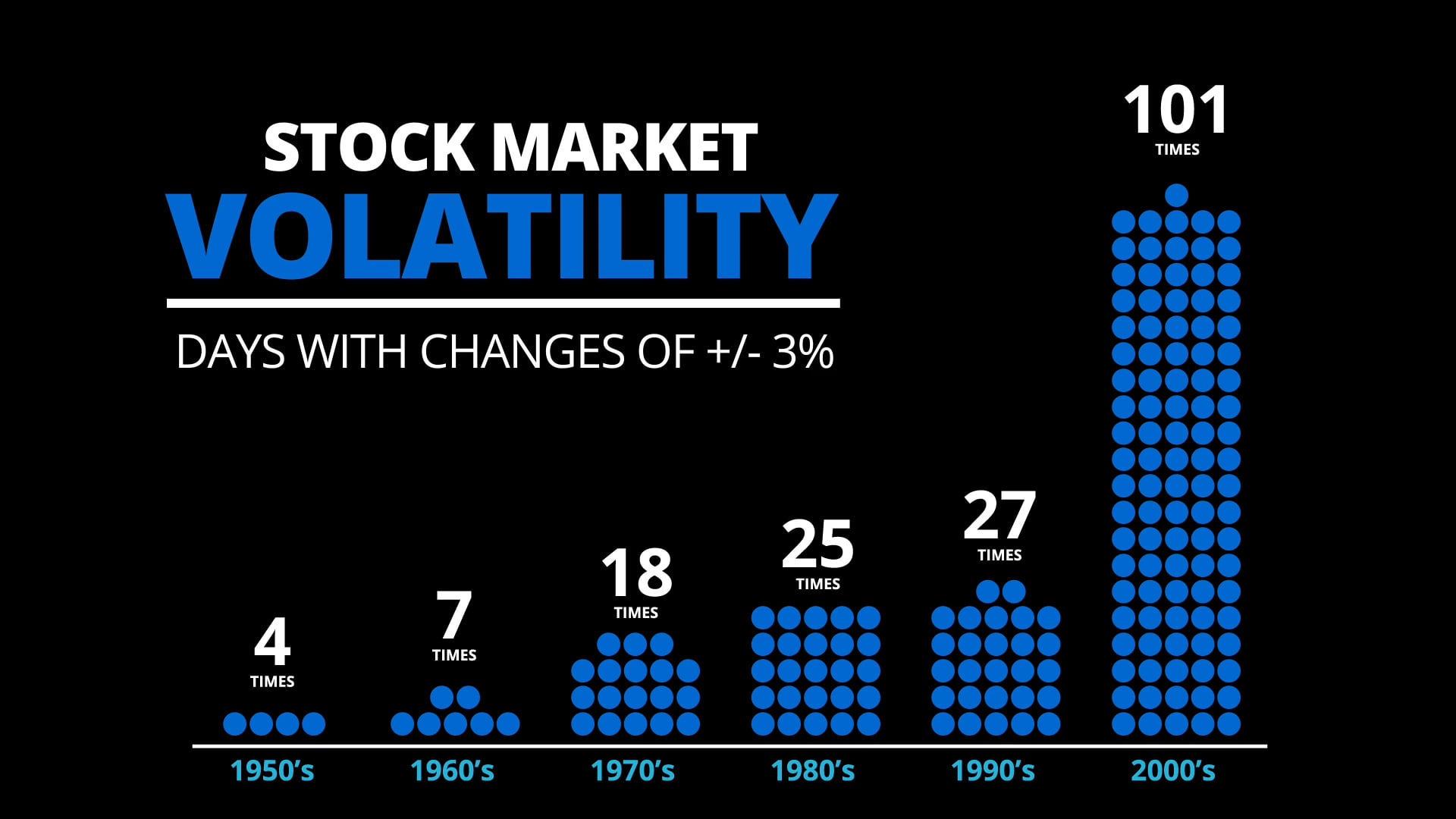

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Advisor

Bruce Wernick, CFBS

Founder

Bruce Wernick, CFBS, is a financial services professional with a distinctive career spanning media and financial planning. A graduate of the University of North Texas with a degree in Journalism, Bruce spent over a decade in the media/entertainment industry before pivoting to financial services. His transition was driven by a recognition of the need for strategic financial guidance, particularly for families and business owners navigating complex transitions.

Holding the Certified Family Business Specialist (CFBS) designation, a rigorous certification offered exclusively to MassMutal financial professionals through The American College, Bruce specializes in helping family-owned businesses address succession planning, governance, and intergenerational wealth transfer. His expertise includes:

- Designing tailored financial plans to protect and grow assets.

- Facilitating business succession strategies to minimize tax burdens and avoid disruptive transitions.

- Balancing family dynamics with business objectives to ensure long-term sustainability.

- Preparing clients for their next stage of life while ensure there is enough resources to live their best lives

Bruce’s hybrid background equips him to bridge the gap between financial theory and real-world challenges, emphasizing education and personalized solutions. Based on Long Island, NY, he serves clients throughout the country and around the world with a focus on trust, integrity, and actionable strategies to secure their financial legacies.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Educational Events

Events in February 2026

- There are no events scheduled during these dates.

Client Events

Events in February 2026

- There are no events scheduled during these dates.

Our Downloads

How to Exit Your Business and Enter Retirement

For many years, you’ve been the captain of your ship. Running your own business hasn’t been easy, and success was never guaranteed. Retirement planning is the next uncharted waters for you, and there’s no one-size-fits-all map. Download our Free Guide to help guide you through the uncharted waters.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.